As a property owner, you may have heard about the 18 year property cycle. Similar to the economic cycle, it is made up of defined phases of growth, recession, and recovery. This may help indicate whether we’re in a boom or bust period. It particularly comes in handy when you’re looking at buying or selling a property. For example, if you could understand where in the 18 year property cycle you were and saw it was the bubble or ‘winner’s curse’ phase, you might hold off purchasing a property. However, as the old saying goes, “it’s time IN the market, not timing the market”.

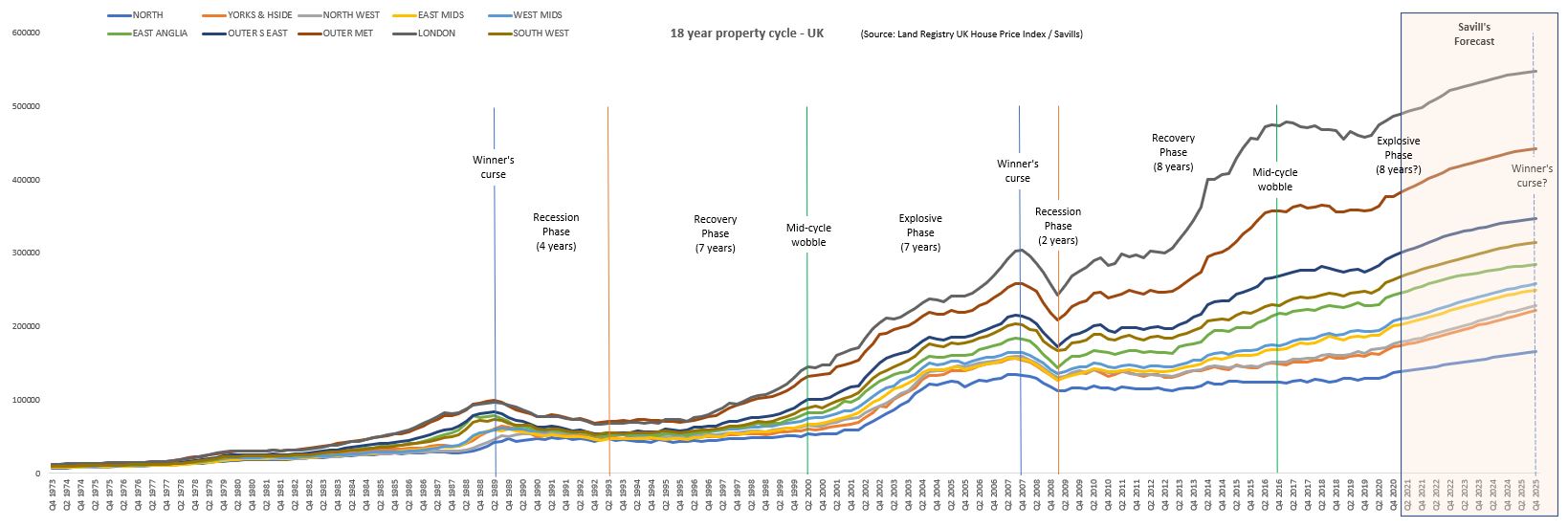

Below, I have sourced information from Land Registry House Price Index and the most recent Savill’s house price forecast (as at March 2021). Note, this is for UK house prices. From this, I have attempted to overlay the 18 year property cycle as best fits. You can kind of see it tracks along those lines, especially between 1999 and 2007.

Taking this into account, we are due for another winner’s curse and crash some time in 2025. Perhaps with the recent Budget announcements to extend the stamp duty holiday and introduce a first-home buyer’s mortgage, this may fuel the next phase of growth post-pandemic.

June 2021 update

An article courtesy of This is Money outlining Fred Harrison’s view of a crash in 2026.

So, what should you out for?

The Explosive / Boom Phase:

- Be wary of what and when you buy, build your cash buffer;

- Property prices rise and demand outweighs supply – ads on RightMove are sold quickly after listing, sold at or above asking prices;

- Rents rise but not a quickly as personal income or property prices;

- Plenty of finance (mortgages) available, higher loan-to-value amounts – e.g. low deposits required;

- Few repossessions by lenders;

- There are few mortgagee/forced sales;

- The media (and everyone you know – Uber drivers, Dave down at the pub) are constantly discussing the increase in property prices and housing affordability;

- Property ‘gurus’ jumping on the bandwagon to spruik courses and webinars.

The Recession / Crash Phase:

- Great time to purchase and build your portfolio;

- Property prices fall (or crash as seen in 2008) – ads on RightMove now take longer to sell, reductions in asking prices;

- Rise in vacant properties, causing rental prices to fall (supply exceeds demands);

- Availability of finance (mortgages) becomes restricted, increased scrutiny of finances and affordability;

- Increased repossessions by lenders and rise in auction listings for repossessed properties;

- The media (and everyone) are talking about the crash and fall in house prices.

The Recovery / Re-Building Phase:

- Good time to continue investing, review your portfolio;

- Stable or inflation-linked increases in property prices and rents;

- Availability and number of finance products increase, steady employment and income growth;

- The media tend to have conflicting stories each week – one week the property market is booming, the next week it’s crashing;Further reading

There are plenty of articles and sites out there if you would like more information about the 18 year property cycle. Some of the content provided by Rob and Rob over at The Property Hub (and Property Geek) are excellent.

Property Geek – Understanding the 18-year Property Cycle